Stay Upgraded with Market Trends on a Leading Forex Trading Forum

Stay Upgraded with Market Trends on a Leading Forex Trading Forum

Blog Article

The Importance of Currency Exchange in Global Profession and Business

Currency exchange offers as the foundation of worldwide trade and commerce, allowing smooth purchases in between diverse economic climates. Its effect extends beyond simple conversions, affecting prices techniques and revenue margins that are crucial for services operating worldwide. As variations in currency exchange rate can pose considerable risks, efficient money danger management becomes paramount for preserving an affordable side. Understanding these characteristics is necessary, particularly in a significantly interconnected market where geopolitical unpredictabilities can better complicate the landscape. What are the implications of these factors on market ease of access and long-term service methods?

Duty of Currency Exchange

Currency exchange plays an important duty in promoting worldwide profession by allowing transactions in between parties operating in different money. As services progressively take part in global markets, the requirement for effective currency exchange devices becomes vital. Exchange rates, which change based on numerous financial indications, identify the worth of one currency about one more, influencing profession characteristics considerably.

Additionally, currency exchange minimizes dangers connected with foreign purchases by providing hedging choices that protect versus damaging currency motions. This financial device allows services to maintain their prices and profits, additionally advertising worldwide trade. In recap, the role of currency exchange is central to the performance of international commerce, offering the important structure for cross-border deals and supporting economic growth worldwide.

Effect On Pricing Approaches

The devices of money exchange significantly affect prices approaches for services engaged in international trade. When a residential money enhances versus foreign money, imported products may become much less costly, permitting companies to lower rates or raise market competitiveness.

Companies often take on prices techniques such as localization, where prices are customized to each market based on currency fluctuations and local financial elements. Additionally, vibrant prices versions might be utilized to react to real-time money movements, making certain that services stay agile and affordable.

Impact on Profit Margins

Changing exchange prices can exceptionally influence earnings margins for companies participated in global profession. When link a company exports items, the income created frequents a foreign money. If the worth of that money lowers about the company's home currency, the earnings recognized from sales can reduce dramatically. Conversely, if the international money values, earnings margins can raise, improving the general financial efficiency of business.

Additionally, services importing items encounter comparable threats. A decline in the value of their home money can result in greater costs for international items, consequently squeezing revenue margins. This scenario demands reliable money risk monitoring methods, such as hedging, to reduce prospective losses.

In addition, the influence of currency exchange rate variations is not limited to direct purchases. It can likewise affect prices methods, competitive positioning, and general market characteristics. Companies must stay alert in keeping an eye on money trends and readjusting their economic strategies as necessary to protect their profits. In summary, understanding and managing the impact of currency exchange on profit margins is essential for organizations striving to keep earnings in the facility landscape of worldwide trade.

Market Gain Access To and Competition

Navigating the complexities of international trade calls for businesses not only to take care of profit margins yet also to make certain efficient market access and you could look here boost competitiveness. Money exchange plays a pivotal role in this context, as it directly affects a firm's ability to get in new markets and complete on a worldwide range.

A favorable currency exchange rate can decrease the cost of exporting items, making products more appealing to foreign customers. On the other hand, a negative rate can pump up costs, impeding market penetration. Companies should strategically handle currency changes to enhance prices approaches and continue to be competitive against regional and global players.

Additionally, organizations that efficiently use currency exchange can create opportunities for diversification in markets with beneficial problems. By developing a solid existence in several currencies, companies can reduce risks related to reliance on a solitary market. forex trading forum. This multi-currency technique not just boosts competition but also fosters resilience in the face of financial shifts

Risks and Challenges in Exchange

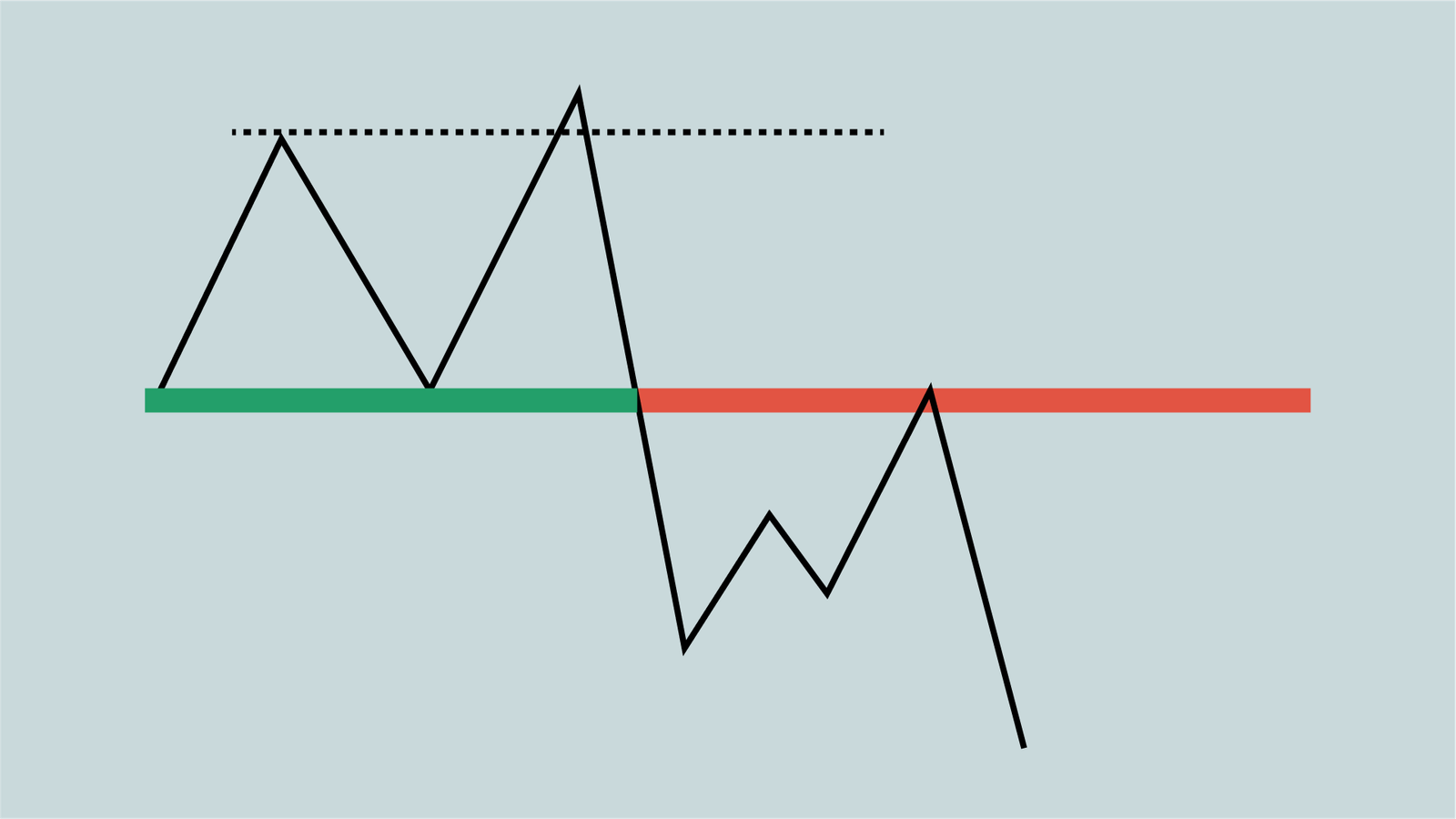

In the world of international profession, companies face significant threats and difficulties related to money exchange that can affect their monetary stability and functional methods. One of the key dangers is currency exchange rate volatility, which can lead to unexpected losses when transforming currencies. Fluctuations in exchange prices can impact profit margins, specifically for business engaged in import and export tasks.

In addition, geopolitical aspects, such as political instability and regulatory adjustments, can intensify money dangers. These elements might result in abrupt changes in money values, making complex financial projecting and planning. In addition, services should navigate the intricacies of forex markets, which can be influenced by macroeconomic signs and market sentiment.

Conclusion

In final thought, money exchange serves as a keystone of worldwide profession and commerce, facilitating purchases and enhancing market liquidity. Despite integral dangers and obstacles associated with rising and fall exchange rates, more information the relevance of currency exchange in promoting financial growth and durability stays obvious.

Report this page